According to Council for Disability Awareness, 1 in 8 workers will be disabled for five years or more during their working careers. That’s why the Council for Disability Awareness designated the month of May as Disability Insurance Awareness Month — a full 31 days dedicated to educating individuals on the effects of disabilities.

And since a disability from an illness —the cause of 90% of disabilities— can have life-altering consequences both physically and financially, understanding your risks and how to protect yourself is critical. To help you out, here are 5 things you need to know about long-term disabilities.

- What is a long-term disability? Simply put, a long-term disability is an injury or illness that prevents you from working full-time for an extended period of time, and that lasts longer than your disability insurance policy’s elimination period. Long-term disability insurance policies have elimination periods, which are periods of time between the onset of your disability and the time you are eligible for benefits. These elimination periods can range anywhere from 30 to 365 days. And once the elimination period you chose has ended, you will start receiving your disability benefit payout.

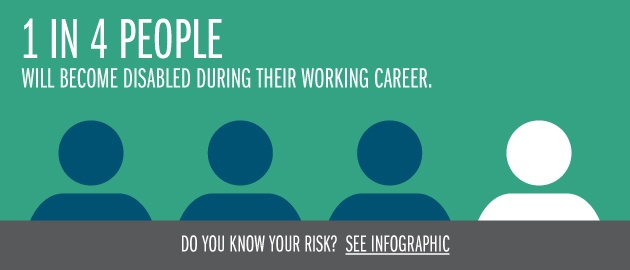

- What are my chances of becoming disabled? Most people greatly underestimate their chances of becoming disabled, and the critical risks a disability poses to their financial security. According to a recent DisabilityCanHappen.org survey, only 1% of people believe they will be out of work for more than three months, yet the Social Security Administration’s 2014 Fact Sheet shows more than 25% of today’s workers will become disabled before they retire. Furthermore, at the age of 40, the average worker has a 21% chance of being disabled for 90 days or more before age 65, compared to only a 14% chance of dying during that time. These statistics reveal the importance of protecting yourself, your family and your income from the effects that a long-term disability could bring.

- How can Long-Term Disability Insurance protect me? A Long-Term Disability Insurance policy is designed to protect your income in the event of an illness and injury. Most policies will cover between 50% to 66% of your monthly gross income up to a specific monthly maximum. To receive benefits, you must be unable to perform the duties of your occupation due to the disability, be under the care of a physician and satisfy the elimination period. If you meet all of these requirements, then you are eligible to receive a payout up to the maximum benefit period.

- Should both residents and practicing physicians invest in Long-Term Disability Insurance? Yes, both physicians and residents should consider obtaining Long-Term Disability insurance. For physicians, a policy will protect your current income in the event of a disability, and enable you to maintain your standard of living. For medical residents, coverage will help protect the investment that you’ve made in school and your family’s future. Residents also have an advantage, as younger and healthier applicants are more likely to receive lower premiums and not have difficulty with medical underwriting.

- When should I seek out this type of insurance? Medical residents should have Long-Term Disability Insurance products at the start of their program, and consider increasing their amount of coverage during the final year of residency. When purchasing this type of coverage, residents may want to opt for a policy that has a graded premium, which will lower the premium amount in the early years of the policy. Once in practice, he or she can switch to a level premium, which will increase the rate but will stay level for the remainder of the life of the policy.

The ultimate goal is to find the insurance product that offers the highest level of coverage at competitive rates. An insurance advisor can share additional information on riders and how to seek out premium discounts based on hospital affiliations and association memberships.

Although you may not be expecting to suffer from a disabling illness or injury, it’s important to protect your financial future. To discuss your options when it comes to disability insurance, contact us today. For more compelling statistics about disability, see our new Disability Infographic.