Imagine going to a very nice restaurant. You sit down at a table and the waiter asks for your order. After you place your order he points to the kitchen and says “Please pick it up in 10 minutes. And when you’re done, kindly bring your dishes back to where you got them.”

Is this the type of service you expect from a high quality restaurant?

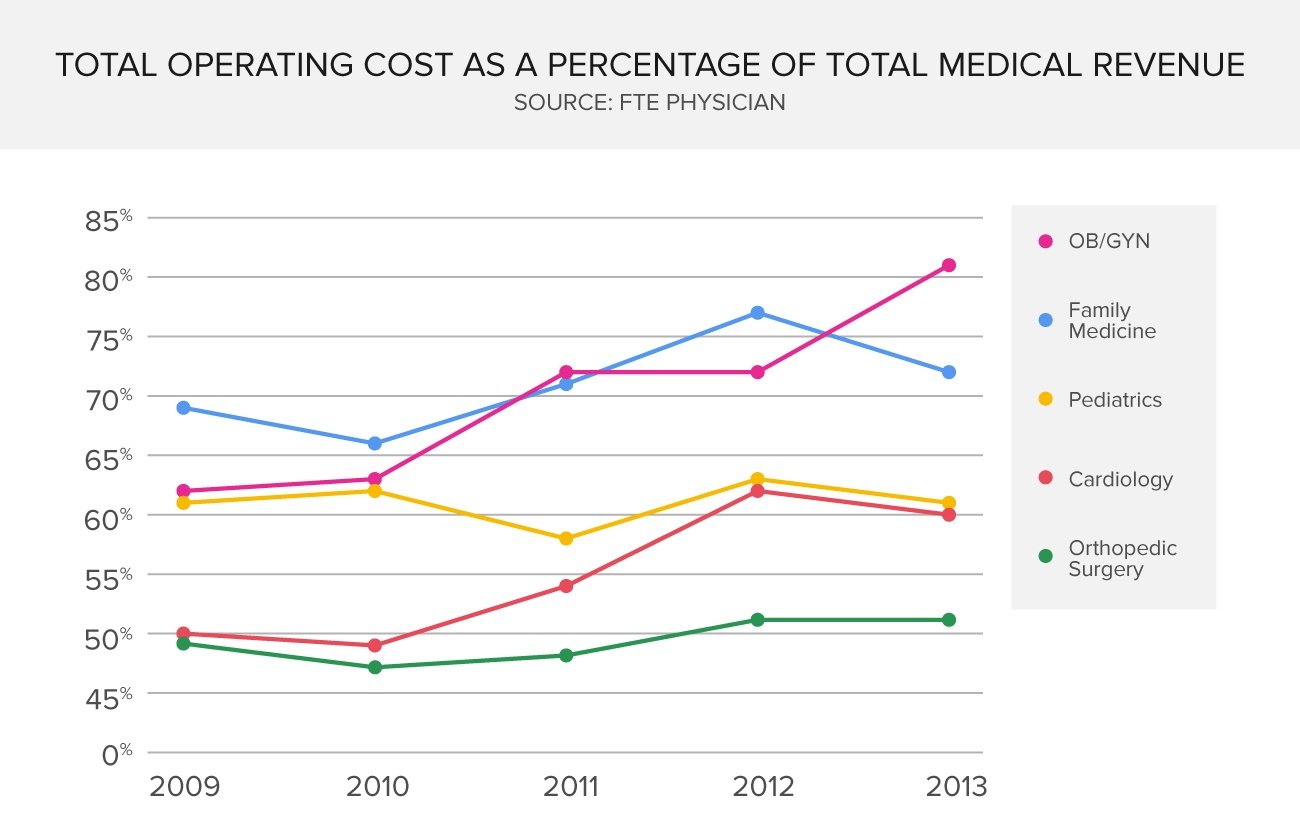

As the owner of a medical practice, we don’t have to tell you that providing group benefits for your employees can be costly. In fact, you could be paying a significant part of your revenue for employee benefits. So it makes sense that you are entitled to ask this question – am I getting the service that I’m paying for?