How many times have you heard: Income protection is vital for every physician.

How many times have you heard: Income protection is vital for every physician.

Probably often enough that you may have tuned it out by now. But here are a few facts that could reinforce just how important it really is to have a good income protection strategy – especially if you’re in the early stages of your career.

The Odds Of Becoming Disabled In Your Career Are 1 In 4*

You may not have thought about it, but over the course of your career there’s a 25% chance that at some point a serious illness or injury might keep you from working. If that were to happen disability insurance can be there to provide much-needed income for you and your family.

You may be thinking “But right now I’m young and healthy. Can’t I do this later when I have more income to protect?”

The truth is, the longer you wait to get disability insurance the more it can cost you.

Lock In A Better Rate Now

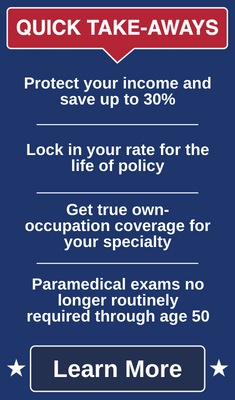

It pays to buy a plan when you’re younger. That’s because coverage costs less when you’re young and healthy. If you get a plan now you may even be able to lock in a good rate for the life of the policy.

Your Current Plan May Have Limits

If you’re practice owner, you may have a policy you obtained years ago, early in your career. If so, it’s likely that your responsibilities have grown, along with your income. You’ll want to be sure you have enough coverage today to be appropriate for your family’s current living expenses.

It’s also good to note that if you’re covering the premiums of your policy as an expense of your practice your benefit may be taxed, which means your benefit payment would be reduced at a critical time when your finances are already strained. (Please consult with a tax professional about your tax liability.)

If you have a plan provided by your employer, it typically comes with limits on how much of a monthly benefit you would receive and for how long you can receive it. And if your employer pays the premium, your benefit will be taxed as income as well. (Please also consult with a tax professional about your tax liability.)

Save Up To 30% For The Life Of Your Policy

If you’re looking for a plan for the first time, or you want to increase the amount of coverage you have, we can help. TMA Insurance Trust has been working with physicians in Texas for over 65 years and we can provide options from leading disability insurance carriers.

One top-rated plan we offer is from Guardian – a nationally known carrier. It comes with discounts of up to 30% for physicians (depending on your specialty) and offers rates that can be locked in until retirement.

Get True Own Occupation Coverage

It also features a true own occupation definition of disability for your specialty. Why is that important? Some “own occupation” policies only provide a benefit if you cannot work in any occupation for which you are reasonably qualified.

So let’s say you’re a cardiothoracic surgeon whose practice is limited to that specialty. If your disability left you unable to perform the duties of your specialty, but you were qualified as an internal medicine physician, you might be required to work in that capacity in order to receive a benefit. You would then, most likely, be working for a fraction of the income you’re earning now.

With Guardian’s true own-occupation definition of total disability, with its specialty language, you could be eligible for your full benefit, and the decision to work in another capacity would be yours – not that of your insurance carrier.

Apply Easily Online

The Guardian plan features a simple application process that can be handled online and paramedical exams are no longer routinely required through age 50.

If you’d like to speak with one of our advisors, they’re here to help. They don’t work for sales-based commissions so you never have to worry about feeling pressured or obligated. To get started, call us at 800-880-8181 Monday through Friday, 8:00 to 5:00 CST.

For over 60 years, TMA Insurance Trust advisors have been serving Texas physicians, their families and staff. TMA Insurance Trust prides itself on offering unbiased information and strategies to members, along with exclusive group rates on a range of the highest-rated plans in the industry.