Right now, your patients are depending on you more than ever; your family may be depending on you in many new ways, and the risk to your own personal safety is greater than in times past. We see that it is a highly stressful time to be a physician, and we want to help. If you are thinking about your needs for life insurance, we want to make the process as simple as possible for you.

Obtaining Life Insurance: New Challenges

The coronavirus has brought unexpected changes to the life insurance industry. This has created complications and delays for some in obtaining the coverage they need. How so?

First, because of social distancing measures and the heavy demand on health care workers at present, a person who applies for life insurance may face delays in getting a physical exam, which is a standard requirement for approval. This is especially true if the amount of coverage is significant.

There is an additional issue to consider. Morningstar recently reported, “U.S. insurers are doing the once unthinkable, turning away business from some Americans who want a life-insurance policy.”* What is the cause? Interest rates have fallen, and some insurers do not expect rates to rebound in the near future. Life insurance companies earn their profit by investing premiums in bonds. They carefully predict how much interest income they will earn with their investments. The lower the interest rate on their investments, the more they need to collect in premiums or fees in order to stay profitable.

How could this affect you as you look for life insurance? Life insurance buyers are currently being faced with an unpleasant wave of changes. Some insurers are suspending sales of certain products. Prices are rising. Policy limits are decreasing, and some benefits are being reduced as well.

Simple Coverage Still Available Through TMA Insurance Trust

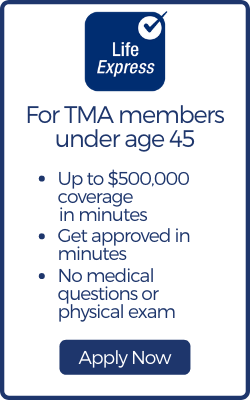

Obtaining life insurance can be easier for Texas physicians. If you are a TMA member under age 45, you can apply online for up to $500,000 of TMA Member Term Life coverage - and you may get approved in minutes. This coverage is issued by The Prudential Insurance Company of America, one of the country’s leading life insurance providers. Select the Life Express link below to apply online.

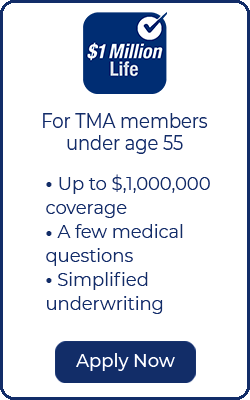

TMA members under age 55 who want more life insurance can also take advantage of our streamlined online application process. You can apply online for a total of up to $1,000,000 of TMA Member Term Life Insurance with simplified underwriting that includes just a few questions. Select the $1 Million Life link below.

If you have questions about your life insurance needs, or want more coverage, you have personal assistance available to you. Our licensed advisors are ready to help you. Contact us today at 1-800-880-8181.

For over 60 years, TMA Insurance Trust advisors have been serving Texas physicians, their families and staff. TMA Insurance Trust prides itself on offering unbiased information and strategies to members, along with exclusive group rates on a range of the highest-rated plans in the industry.