If you’re a young physician or resident, ask yourself this: What if you had an opportunity to invest in a company, knowing that in the years ahead its stock price would rise significantly? Or to purchase a home knowing its market value was certain to increase substantially?

If you’re a young physician or resident, ask yourself this: What if you had an opportunity to invest in a company, knowing that in the years ahead its stock price would rise significantly? Or to purchase a home knowing its market value was certain to increase substantially?

Would you make that investment? Very likely you would.

As a young physician, one of the most important assets you own is the ability to earn a good living. That asset has been gained through hard work, dedication, and sacrifice. And it should be protected accordingly. That is the role of disability insurance – to provide income if you become too sick or injured to work.

Pay Less Now, Get Extra Years Of Coverage

So what if you had an opportunity to pay a lot less now to protect your income – before the cost of doing so goes up? That opportunity is available to you, if you secure disability insurance at this early stage of your career.

As it turns out, getting started now with disability insurance is like getting in on a very good investment when the cost is significantly lower. In fact, getting a plan today can be like getting extra years of coverage at no extra cost.

Don’t Lose Out On Savings

Now, you might think it’s better to postpone getting covered until your income increases later in your career. But the value of getting covered now is that your rate will be low enough, so that over the course of your career, you will pay the same or less than if you wait and secure coverage later. Here’s why:

Typically, when young physicians hear about disability insurance you’re told that the sooner you get it the lower your rates will be. This is true. When you’re younger and healthier your rates are naturally lower. But there’s more to it than that. The longer you wait to get disability insurance the more it can end up costing you. This is what is known as the “Cost of Waiting.” There are three components to this concept:

- Your rate is lower when you’re younger

The first component is the most obvious – when you’re young, you will most likely be your healthiest. Since disability insurance rates are based on your age and health, you will get the most advantageous rate when you secure a policy at this time.

- Lock in your rate for the life of the policy

The second component is that with an individual policy, the rate you will be approved for is the rate you will pay for as long as you hold your policy. It is guaranteed until you reach Social Security retirement age. And because the rates are significantly lower when you secure your policy as a young physician, you could save thousands of dollars over the course of your career.

- Get more years of protection at a lower cost

The third component is the element of time. Not only can you enjoy significant savings over the course of your career, but by securing a policy when you’re younger, you will have more years of income protection at a lower overall cost than if you wait and buy your policy later.

See How The Savings Add Up

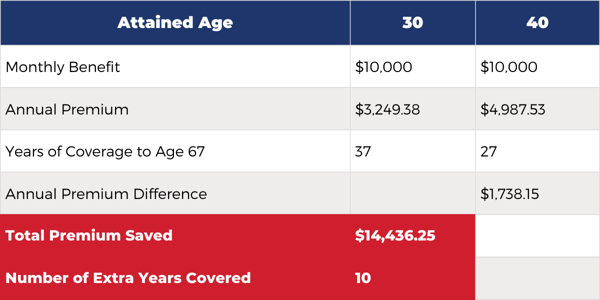

To get a better understanding of what you have to gain by getting a plan now, look at the following hypothetical example. It shows what happens with the same physician if they secure their policy at age 30 versus if they wait until age 40.

For our example, we used the Guardian Provider Choice policy for a male physician, with a 90-day elimination period, 3% cost of living adjustment, Future Increase Option of up to $6,000/month, included enhanced partial disability benefits and applied appropriate discounts that a physician could take advantage of.

As this example shows, it’s advantageous for our physician to secure a policy when they are younger. How advantageous?

By securing this disability plan at age 30, our physician will have 10 extra years of income protection – and will save $14,436.25 over the life of their policy.

Speak With An Advisor, Start Saving Now

Protecting your income is vital for your financial security and that of your family. So get started now and take advantage of the substantial savings that are available to young physicians.

Our advisors can help you get a top-rated plan from a national carrier. When you call during the hours listed below you’ll get a live person on the line to assist you. Call 800-880-8181, Monday through Friday from 8:00 am to 5:00 pm, CST.

For over 60 years, TMA Insurance Trust advisors have been serving Texas physicians, their families and staff. TMA Insurance Trust prides itself on offering unbiased information and strategies to members, along with exclusive group rates on a range of the highest-rated plans in the industry.