Could it get any worse? That’s what so many Texans are asking these days.

With a crippling pandemic, a devastating storm and its disastrous aftermath, the people of Texas – certainly Texas physicians – have seen enough tribulation this past year. It’s become clear that our lives can change dramatically overnight as a result of circumstances over which we have little or no control.

It is from this perspective that we might approach the topic of life insurance.

Life Insurance – Immediate Financial Protection

We may not know what tomorrow may bring – but term life insurance can provide an additional financial safety net if something should happen to us and we are no longer here to provide support for our family.

Not many financial strategies can match the immediate protection of term life insurance. Once your policy is in place, your coverage begins and therefore provides immediate financial protection for your family. You do not have to wait years to build equity – as with other financial strategies like a savings plan or investment funds. Your family has financial protection from day one.

That said, it is important to find the right plan – with the right coverage at the right cost – that works for you and your family.

So here are a few considerations to bear in mind as you explore your options for life insurance.

Your Employer-Provided Coverage May Be Limited

Like many physicians, you may have some life insurance that is provided by your employer. As a result, you may feel you have “checked that box” in your portfolio of essential insurance coverage.

Employer-provided life insurance, however, often comes with limitations. For instance, if years have passed since you first obtained your policy, it’s possible that your life has changed and your needs are more complex. If your family has grown, you may need more coverage now than your original plan provides.

It’s a good idea to review your plan to see if you have enough coverage to provide for your family’s needs today. Unfortunately, with employer-provided life insurance, it’s not always possible to increase your coverage. If that’s the case, you may want to consider getting your own personal life insurance plan.

A Personal Plan Has Advantages

You can look for a personal life insurance plan that not only provides increased coverage but also fits your budget.

One important benefit of a personal policy you might get outside of your employment is that it will be portable – so it can stay with you throughout your career and your life, whether you decide to remain employed, or choose to open your own practice.

Get More Coverage To Help Cover Student Loan Debt

If you do opt to get your own plan, you may want to consider the amount of your student loan debt – and whether or not there is a co-signer on your loan.

If you have a co-signer on your loan, you should find out what the financial consequences would be for them if you are no longer here to make your payments. Depending on your loan situation – whether you have a federal, private, or state loan – a co-signer’s estate could be compelled to repay the loan if you are not here to do so.

It’s a good idea to take into account your student loan obligations and who is responsible for repayment when choosing how much coverage to obtain. If your family helped you pay for medical school, you likely would not want to leave them saddled with responsibility for this debt.

The Best Time To Buy – When You’re Young

Something else to consider: If you are young and healthy, you’ll be able to get the most affordable rates on term life insurance – which means you'll be able to purchase more coverage.

As an example: a female physician, age 35, can get $500,000 of term life Insurance from a top-rated carrier for $27.50 per month.

Remember, the best time to buy life insurance is before your next birthday.

Apply Now – Quickly And Easily

It doesn’t matter whether your goal is to secure a significant amount of coverage, or to find the most affordable plan, TMA Insurance Trust can help.

We can help you review your options from leading national carriers as well as take advantage of time-saving opportunities.

We know that as a physician, you’re pressed for time. So we’ve made the process of getting life insurance fast and easy – so easy you can apply right now from your phone.

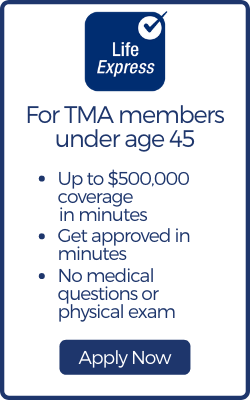

- If you are a TMA Member under age 45, you can apply online for up to $500,000 of TMA Member Term Life and get an approval in minutes by clicking on the Life Express button below.

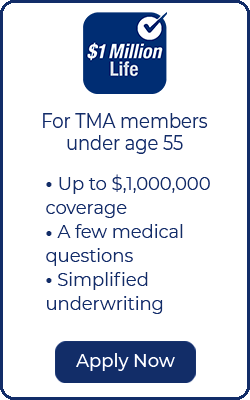

- If you are a TMA Member under age 55, you can apply online for up to $1,000,000 of coverage with simplified underwriting by clicking on the $1 Million Life button below.

If you need more coverage, you can apply for up to $2,000,000 of TMA Member Term Life coverage by contacting one of our experienced advisors. They can also provide quotes from a range of other top-rated national carriers.

One thing you should know: our advisors do not work for sales-based commissions, so you will never feel any pressure or obligation.

While we continue to live and work through challenging times, we want you to know that we are here to help you find the financial protection you want for your family. Get started now. You can call us at 1-800-880-8181 or click on the appropriate button below.

For over 60 years, TMA Insurance Trust advisors have been serving Texas physicians, their families and staff. TMA Insurance Trust prides itself on offering unbiased information and strategies to members, along with exclusive group rates on a range of the highest-rated plans in the industry.