As a physician, you have worked hard to achieve much in your life. As you plan for your future, you think of investment strategies and savings plans. If something should happen to you, financial protection for your loved ones is of paramount importance.

One of the best ways to offer immediate financial protection is to obtain a term life insurance policy, whereas many savings plans and investment strategies require time to build value. Once you are approved for a term life insurance policy, your amount of coverage is in place, and immediately helps to provide protection. Term life insurance provides financial protection for your family when they need it the most.

Other savings and investment plans have a place in your financial portfolio, but they build value over time, whereas term life insurance helps provide protection from the very day that the policy becomes effective. It is reasonable, then, to have immediate protection in place from the very start.

But I have life insurance coverage from my employer...

Many employed physicians do have life insurance coverage through their employers. However, ‘some’ coverage may not be enough to provide proper protection for your individual needs. What is more, some physicians are not able to purchase more life insurance through their employer. How will you know if you have enough coverage? A conversation with an unbiased advisor who does not earn sales-based commissions will give you the insight you need. Plan now to have a conversation with a trustworthy guide; the best time to add coverage is before your next birthday, when your rates will likely increase.

But I don’t have a family to provide for; I won’t need this coverage now…

Perhaps you don’t think of purchasing more life insurance coverage because you are young and don’t have a family who depends on you. But if this is the case, you may have outstanding education loans that you must repay. If you have a cosigner on your loans, you have an additional level of responsibility. What will the financial consequences be if you pass away and your co-signer is left to repay the loan? What if their family is in need of a financial safety net? What would happen to their family’s life savings and retirement plans if suddenly they had to repay your medical school debt? Though federal student loans are discharged at death, private and certain state loans are another matter. Depending on certain laws, the co-signer’s estate may be forced to repay the loan. Adequate term life insurance coverage can provide for your co-signer's financial need if they are forced to repay your debt.

But I have the life insurance coverage that I need at the moment, so I don’t need to think about this...

Adding more coverage now may seem like an unnecessary expense. But while you are young and healthy, it is the best time to lock in more protection that you will likely need in the future for those who will depend on your income for their financial well-being. As an example, a female physician aged 35 can get $250,000 of TMA Member Life Insurance for about $14 a month.

Additionally, many if not most physicians early in their career will not stay with their current employer permanently. Should you change employers or start your own practice, know that your current life insurance is likely not portable and will not go with you. By choosing a new policy outside of your employment, you choose portable insurance that can travel with you throughout your life.

We Are Your Trusted Partner in Protection

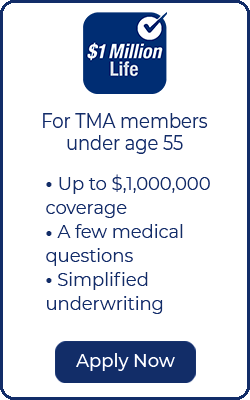

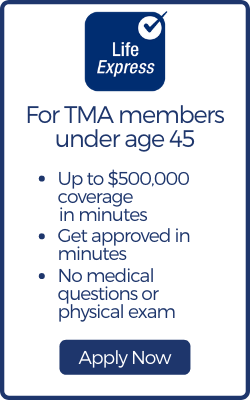

As a TMA member, you can avail yourself of options that aren’t available to non-members. To make obtaining life insurance fast and easy for you, here are links to time-saving application processes you can reach right from your desktop or mobile device. Protecting your loved ones with quality life insurance has never been so fast and easy.

Want More Options?

More Life Insurance options from leading carriers in Texas are available through TMA Insurance Trust. Our life insurance advisors are available weekdays from 7:30 a.m. to 5:30 p.m. CST to answer your questions, review your current life insurance policies, and compare quotes from several of the top-rated insurance companies in the nation. Call us today at 1-800-880-8181.

For over 60 years, TMA Insurance Trust advisors have been serving Texas physicians, their families and staff. TMA Insurance Trust prides itself on offering unbiased information and strategies to members, along with exclusive group rates on a range of the highest-rated plans in the industry.