There’s an old episode of “The X-Files” in which insurance salesman Clyde Bruckman, played by Peter Boyle of “Everybody Loves Raymond,” sits with a young couple at their kitchen table trying to sell them an insurance policy.

The husband and wife smile slyly at one another.

“You see,” the husband says, “we were really hoping to buy a boat.”

Bruckman is not deterred. He’s heard that one before, and he knows just what to say.

“Mr. Gordon, as a young husband, I think you’re going to find that your new responsibilities to your family take precedent over your recreational needs.”

The husband pauses, looks at his wife.

“But this is a really good boat.”

A mundane and all-too-familiar situation, to be sure, but on a show about the paranormal; naturally, something sinister had to be going on. There was a reason Clyde Bruckman chose to spend his days as a floundering insurance salesman: he could see the future.

More specifically, he could tell exactly when and how the people he met were going to die. And while that would seem to be every insurance salesman’s dream, Bruckman used his powers virtuously, trying to help his customers prepare in advance for their inevitable losses.

Bruckman sighs in exasperation.

“You don’t get it, do you, kid?” he says, eyes darkening. “Two years from now, while driving down Route 91, coming home to your wife and baby daughter, you’re going to be hit head-on by a drunk driver in a blue ’87 Mustang.”

The couple is, of course, horrified. Unaware of Bruckman’s unlikely ability, they refuse to buy in. Showing him the door, the young husband says, “Mister, you really need to work on your closing technique.”

But I Can’t See the Future

Why do I bring all this up? Because unless you can see the future, you may not be able to tell the value of an insurance policy.

Or can you?

Today, Bruckman’s powers wouldn’t seem so supernatural. As recently as 2010, good data on the chances of becoming disabled were hard to come by. But in the era of big data, mountains of statistics can accurately detail how often an injury or medical condition impacts American physicians.

RELATED: The Compelling Facts About Disability [Infographic]

Don’t Feel So Safe

You may have heard that roughly 1-in-3 of today’s working 20-year-olds will experience a disability before they retire and that the average long-term disability claim lasts more than 30 months.

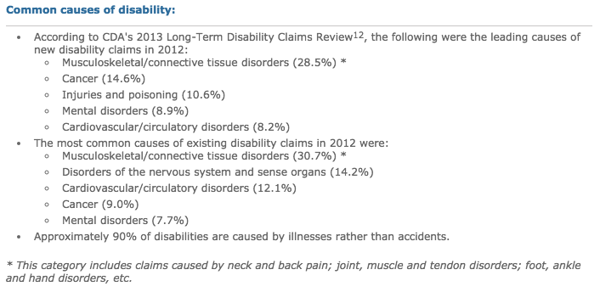

As a physician, you probably also know that those millions of cases aren’t all injured goods manufacturers, construction crewmembers, and guys who move refrigerators for a living. Around 90 percent of disabilities are caused not by injuries but illnesses, of which health care has a high incidence compared with most professions.

The Council for Disability Awareness (CDA), a nonprofit, notes that disabilities happen much more often than most people assume, with 64 percent of wage earners believing “they have a 2% or less chance of being disabled for 3 months or more during their working career.” In addition, the council’s 2012 statistics parceled out the most common causes of long-term disabilities.

Is Long-Term Disability Insurance Really Worth it?

When making a purchase decision it is rational behavior to think in terms of what you are getting for your money. This oftentimes turns into an investment analysis -- how much am I paying and what do I get in return? Often this is the best way to look at a purchase decision. But when making up your mind whether or not to purchase disability insurance, this way of thinking can potentially get you into trouble.

A better way of deciding whether or not your need long-term disability insurance is to ask yourself a simple question: How will I survive if I am no longer able to make a living? If the answer is that you have enough assets to cover your standard of living for the rest of your life without earning additional income, or if family can support you, you may not need long-term disability insurance. But if you don’t have assets to fund your living expenses, and if you don’t have another person who can support you, your safest bet is to own income protection so that you will not face a potential catastrophic situation should you become unable to work due to an illness or injury. For a reasonable expense you can easily afford you protect against a worst-case scenario.

Or, as Clyde Bruckman would say, she has done the right thing by putting her responsibilities to family ahead of a little extra cash.

RELATED: Young Physicians Shouldn’t Leave Their Careers to Chance

Seeing Into the Future

If you really want to walk a mile in a fortune teller’s shoes, the CDA offers a Personal Disability Quotient (PDQ) Calculator to estimate your chances of becoming badly injured or gravely ill. It also predicts your earnable income quotient, or the amount you will make throughout your career if you are able to work continuously until retirement. (This is what you stand to lose if you have a career-ending injury).

No crystal ball, however, whether powered by mysticism or algorithm, can tell you for a fact if you will need coverage. But regardless of whether they ever use it, physicians who choose to protect their incomes with long-term disability insurance receive a fair value for their dollar, even if there’s a really good boat they’d rather have instead.

If you found this article helpful, may we suggest:

- For more on how to get the ball rolling on a disability plan, read How to Choose a Long-Term Disability Policy in Under 20 Minutes.

- For more on what to do if you become permanently disabled and own a private practice, read Must Knows for Funding Your Buy-Sell Agreement.

- For more on where to find help for physicians in planning for a financial future, read 6 Benefits of Being a TMA Member Physician.